US-China Tariff Truce Extended for 90 Days

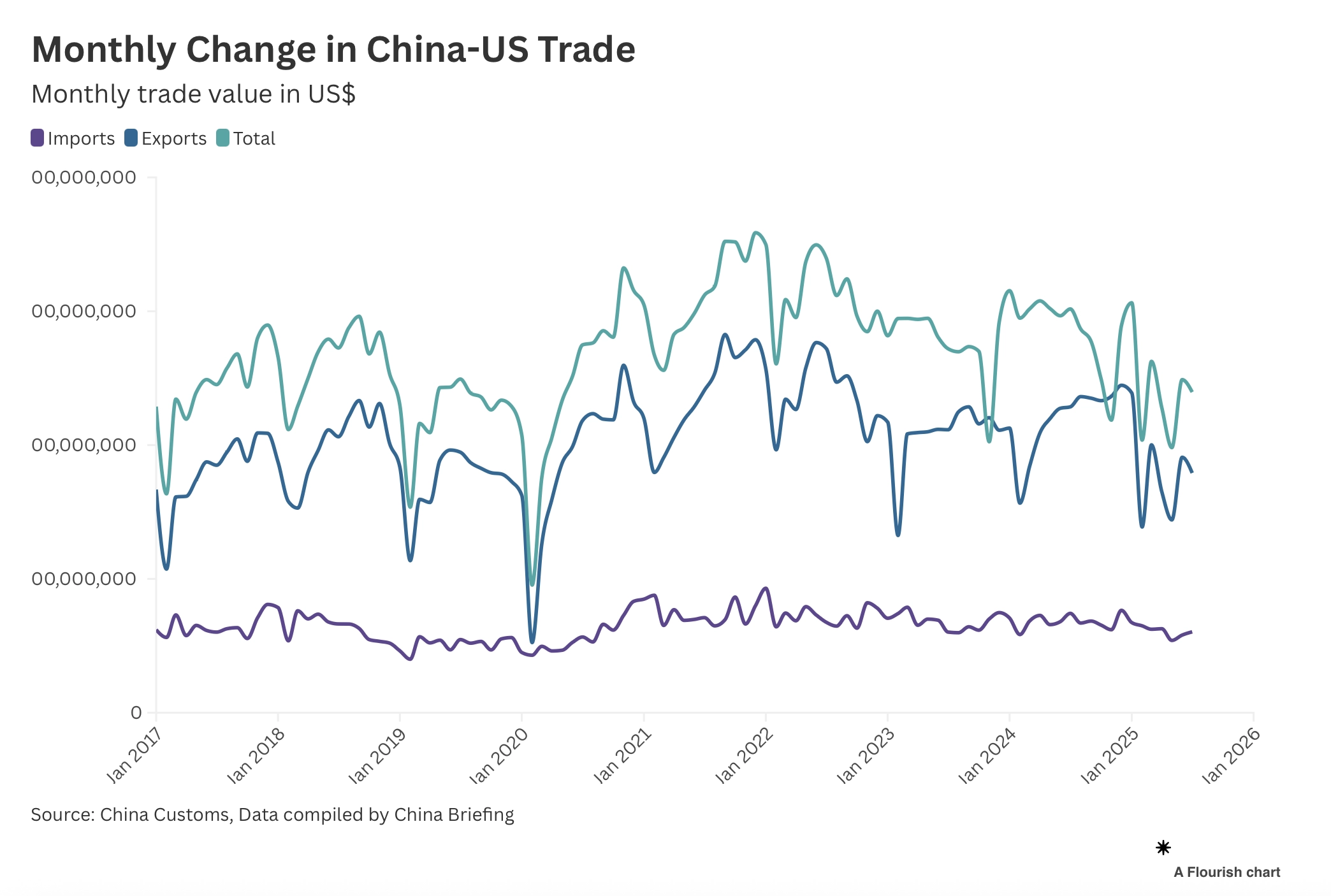

The tariff truce extended between the United States and China for another 90 days offers a vital reprieve for global businesses bracing for the holiday shopping surge. Signed by President Trump on August 11, 2025, this extension halts a steep increase in reciprocal tariffs—capping U.S. duties on Chinese goods at 30% and Chinese tariffs on U.S. imports at 10%—through November 10, 2025

Why Was the Tariff Truce Extended for 90 Days?

The decision to extend the tariff truce came after weeks of tense negotiations between Washington and Beijing. Without this pause, both sides were poised to escalate duties dramatically—to as high as 145% on certain U.S. imports from China, and up to 125% on Chinese tariffs against American goods. Such a move could have destabilized financial markets, pushed consumer prices higher, and disrupted the fragile global recovery. Policymakers on both sides recognized that maintaining stability was in their mutual interest.

At the same time, the extension reflects political calculations. President Trump, heading into a contentious election season, sought to avoid a trade shock that could damage consumer confidence. For China, the truce provided breathing space to manage domestic economic headwinds while signaling goodwill before a possible summit between Trump and Xi Jinping. Analysts interpret the extension as a temporary de-escalation, not a long-term resolution, highlighting how fragile the trade relationship remains.

What Are the Implications for Holiday Season Trade?

For businesses, the timing could not have been more critical. The 90-day extension overlaps with the busiest retail period of the year, when U.S. and global consumers drive demand for electronics, apparel, and household goods—many of which originate from Chinese factories. Retailers and shipping companies had feared severe inventory shortages, surging prices, and logistical chaos if tariffs had jumped before the holiday rush. The truce provides reassurance that current pricing structures can remain intact through the peak season.

Global financial markets also reacted positively. Stock indices across Asia rose following the announcement, reflecting investor relief that the world’s two largest economies would not enter a new phase of tariff escalation. For supply chain managers, the extension translates into greater predictability in procurement, shipping schedules, and customs procedures. While uncertainties remain, the holiday quarter is now less likely to be overshadowed by sudden cost spikes or delays.

How Are Businesses Responding to the 90-Day Extension?

Multinational corporations, particularly in sectors like technology, automotive, and consumer goods, welcomed the extension as a window of opportunity. Many firms are using this time to accelerate shipments, stockpile key components, and renegotiate contracts with suppliers. The shipping industry, in particular, expects steadier volumes as companies rush to take advantage of the tariff freeze before November 10. Logistics hubs in both the U.S. and Asia are already reporting an uptick in activity.

Small and medium-sized enterprises (SMEs) also benefit from the truce. These firms often lack the financial buffers of larger corporations and are more vulnerable to tariff shocks. For them, the 90-day pause means preserved margins and more time to adjust sourcing strategies. Some SMEs are exploring diversification, moving portions of their supply chain to Southeast Asia or Mexico, but the truce buys valuable time to plan such transitions carefully.

When Does the Truce End—and What’s Next?

The extension expires on November 10, 2025, setting a clear deadline for negotiators to achieve meaningful progress. Upcoming talks will focus on long-standing disputes, including agricultural exports, market access for U.S. technology firms, and Beijing’s request for the removal of fentanyl-related restrictions. Li Chenggang, China’s top trade negotiator, is scheduled to visit Washington in late August to set the tone for these high-stakes discussions.

Yet uncertainty looms. If talks collapse, the deferred tariff hikes could still be imposed, creating a sharp shock to global trade. Alternatively, another extension—or even a partial deal—remains possible if both sides view cooperation as politically and economically advantageous. Investors, policymakers, and businesses alike will closely monitor signals from both governments, knowing that the cost of failure is measured not only in tariffs but also in global economic confidence.